One-Minute Summary

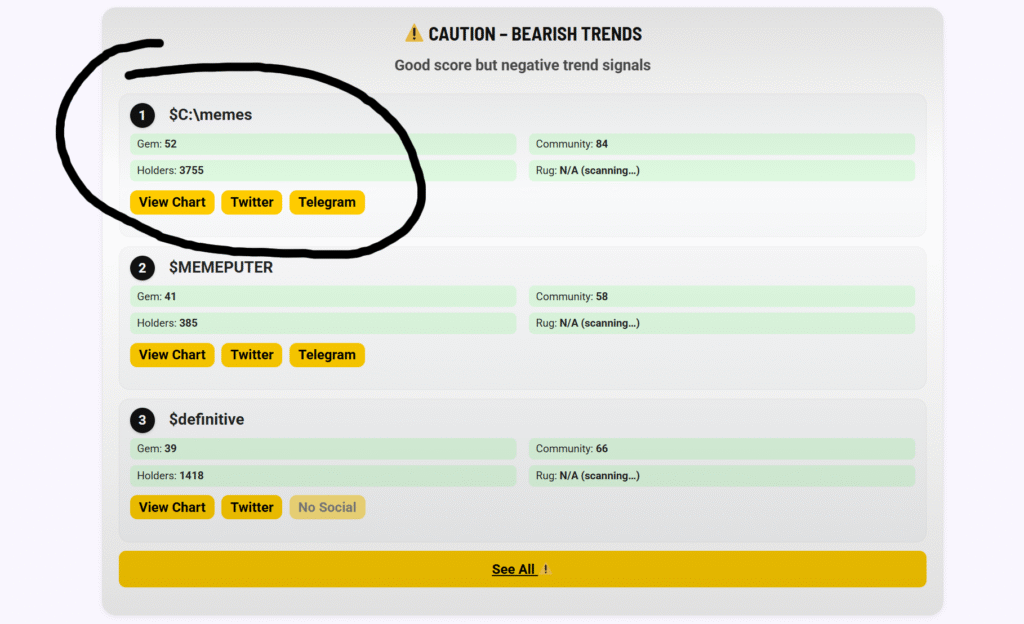

- 9io status: Caution – Bearish Trends (good score, but trend signals still negative).

- Market snapshot (today): price ~$0.0005937 (+86% 24h; +10.6% 1h), mcap ~$594k, liquidity ~$59k, 24h volume ~$70k, ~552 tx/24h, ~2.0k–3.8k holders (source differences; 9io currently shows 3,755).

- Price action: two quick expansion legs to ~0.000472 and ~0.000688, with elevated volume and a higher daily close — a classic momentum spike.

- Utility / social drivers: a Telegram coinflip game + an announced Hyperon partnership (on-chain mini-games, AI meme generator, raffles/coinflips).

- Risks: micro-cap, thin liquidity → high slippage & volatility; memecoin (no fundamental cash flows); holder concentration typical for early projects.

- Tactical (NFA): avoid chasing a +86% day; watch for pullbacks to prior breakout zones and a confirmed higher low with sustained volume.

Context: Why C:\memes Is in Focus Now

C:\memes is a Solana memecoin with nostalgic “Windows folder” branding. It’s heavily community-driven: meme culture, light humor, and small mini-utilities (e.g., a Telegram coinflip game) keep engagement up. Over the last 24 hours we saw an aggressive momentum spike: +86% on the day, with two sharp expansions to ~0.000472 and ~0.000688, and a higher close — a sign buyers controlled most of the session.

On the 9io Live Feed, the token still sits in Caution – Bearish Trends. Translation: composite quality scores (e.g., Gem/Community) look good, but trend algorithms still flag risk (e.g., a fresh higher-TF downtrend or an unfavorable structure pre-spike). Typical case where a fast intraday impulse outruns slower trend indicators — a reason for caution, not panic.

Uptober is HERE.. are you ready? #100x #memes #gems #sol #bonk pic.twitter.com/btNPDVXtEE

— C:\Memes (@Cdesktopmemes) October 1, 2025

Market Snapshot & Flow Quality (Liquidity)

- Price: ~$0.0005937

- 24h change: +86% (daily), +10.6% (hourly)

- Market cap: ~$593.7k (micro-cap)

- Liquidity: ~$59.3k (main SOL DEX pair)

- 24h volume: ~$70.1k, 552 transactions

- Holders: ~2,049–3,755 (varies by source/time; 9io currently shows 3,755)

What it means:

For a micro-cap, ~$59k liquidity is thin relative to mcap. Expect slippage and a sensitive order book: relatively small orders can move price quickly. Daily volume (~$70k) is decent for this size, but price impact remains significant on larger orders.

Technical Structure: What the Chart Says

Momentum expanded in two legs (to ~0.000472 then ~0.000688), and the session closed higher. That’s a textbook FOMO burst:

- Bullish: higher close after expansion + rising volume → buyers in control.

- Bearish risk: when the daily bar is large and “full,” the next session often mean-reverts/pulls back (profit-taking, rebalancing).

Key zones (approx.):

- R1: ~0.000688 (last leg high) — first short-term resistance.

- R2: 0.00080–0.00085 — where many similar run-ups stall.

- R3 (psych): 0.0010 — round number and ~2× from 0.0005.

- S1 (breakout retest): 0.00047–0.00050 — reclaim + retest as a higher low is a healthy scenario.

- S2: 0.00042–0.00044 — deeper pullback, still bull-valid if buyers defend.

- Short-trend invalidation: a clean break & close below ~0.00036–0.00038 (kills the last impulse).

What to look for on a pullback (NFA):

- Compression + HL: volatility contraction, then a higher low above S1/S2.

- Volume profile: lighter volume on the dip, heavier on the attempt to continue (confirmation).

- RSI/MA tells: let RSI cool before a second leg; short MA above long MA, with retests acting as support.

Why 9io Shows “Caution – Bearish Trends

9io blends quality scoring (e.g., Gem/Community) with trend models. For C:\memes today:

- Gem ~52, Community ~84 (from the screenshot); holders: 3,755 on 9io → quantitatively okay.

- The trend module likely still sees a broader downtrend on H4/D1 that a single intraday spike doesn’t erase immediately.

Bottom line: quality signals ≠ trend signals. A good score means there’s “material,” but timing is a yellow flag. That’s exactly what you want from a tool — don’t chase if the broader trend isn’t confirmed yet.

“Utility” & Social Flywheel

For memecoins, utility = engagement. Two real flywheels here:

- Telegram coinflip mini-game (fast, “sticky” mechanic — brings users back to chat).

- Announced Hyperon partnership (on-chain mini-games, AI meme generator, raffles/coinflips).

These lightweight utilities won’t create fundamental cash flows, but they extend attention span and increase the chance of organic re-hype (tournaments, rewards, shareable memes). For a memecoin, that often delays fatigue.

Risks: What Can Go Wrong

Thin liquidity vs. mcap: ~$59k LP vs. ~$594k mcap = high slippage and a fragile book; a single larger market sell can crack the chart.

Volatility after +86%: statistically, such days often see mean-reversion in the next 24–72h.

Holder distribution: as with any early token, top wallets can steer the short-term path.

Narrative risk: if the coinflip/Hyperon story stalls or proves short-lived, momentum can fade fast.

Beta risk: if Solana micro-caps flip to risk-off, even “good” charts suffer.

Tactics & Position Management (NFA)

Two main approaches, both with if–then rules:

A) Pullback Buyer

- Where: 0.00047–0.00050 (S1) or deeper 0.00042–0.00044 (S2).

- Look for: a higher low, range contraction, dry-up volume on the dip, then expansion with rising volume.

- Risk: knife-catching if momentum fully dies; use partial scaling and a hard invalidation below the zone (e.g., hard stop under 0.00042 if you bought S1).

B) Momentum / Continuation Buyer

- Where: reclaim & close above ~0.000688, small consolidation above, then a range break continuation.

- Look for: breakout with volume confirmation and no instant slap-back.

- Risk: breakout failure (trap), especially on thin LP; keep risk per trade small.

Take-profit map: partial TPs at R1, R2, keep a runner for 0.0010 if the market supports another leg.

Positioning: micro-cap ⇒ small sizing, scale in/out.

How to Use 9io Signaling With This Chart

Live Feed / Daily Insights already gives you the quality context (Gem/Community) and a trend label (Caution).

Treat Caution as a filter: “Quality exists — now confirm timing on the chart.”

Routine: (1) 9io scan → (2) technical confirmation → (3) trade plan (entry, stop, TP).

Journal every decision and compare with 9io status at entry/exit.

Conclusion

C:\memes currently sits in a micro-cap “sweet spot”: fresh momentum, a valid community hook (coinflip + Hyperon), and clear technical landmarks after a strong day. But the same factors that lift it — thin liquidity & memetic hype — also make it very risky. Caution – Bearish Trends on 9io is the right yellow card: quality signals are there, but trend confirmation still needs to show up.

If you’re a disciplined trader, let price come to you:

- Pullback toward 0.00047–0.00050 with a higher low and healthy volume is a rational setup,

- or only above ~0.000688 after consolidation and a confirmed breakout.

In both cases: keep sizing small, define your stop, scale TPs.

NFA. DYOR.